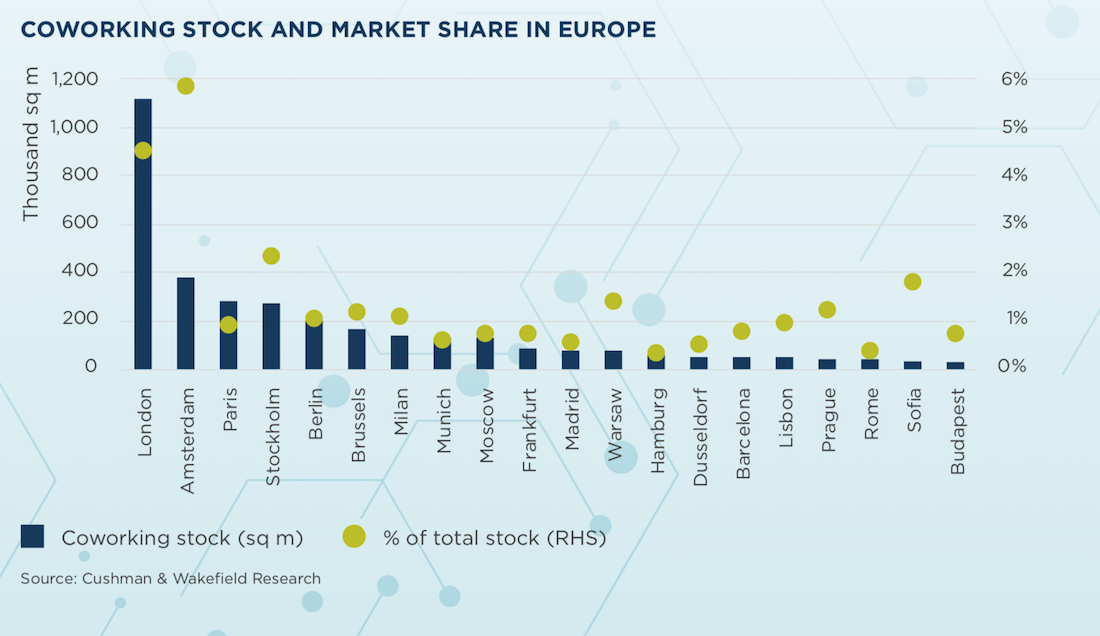

The fast growth of the coworking spaces in London in the last years has led many markets participants to discuss the future of the workplaces in Europe: what are the key factors that foster the development of coworking spaces? Is this going to be a wide-spread trend or it is bound to be a local feature? The Cushman & Wakefield’s European Coworking Hotspot Index gives us a hint of those factors which can have a positive impact of the coworking’s development: scale, business environment, people and catalyst.

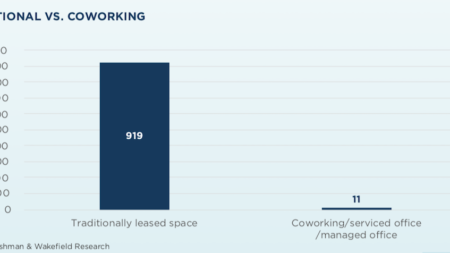

11 million sqm: this is the world surface occupied by coworking spaces and serviced offices, and 22% of these are in London or New York, while, in Italy, Milan represents 1,1%, followed by Rome (0,4%). Nevertheless, even in Italy coworking appears to be a growing trend: in Milan, for instance, the number of spaces for more flexible ways of working has increased from 2% to 10% since 2016.

“Today we meet more corporate companies that, while maintaining the HQ as the core of the brand identity, are looking for more flexible spaces to that allows them to more easily and less costly follow the expansion-contraction of the market”, Lamberto Agostini, EMEA Cushman & Wakefield Project & Development Services Manager, says.

So, how is it possible to better understand the evolution of the real estate and of the coworking? Is it possible, analyzing the example of London, to design models that can be applied to other realities?

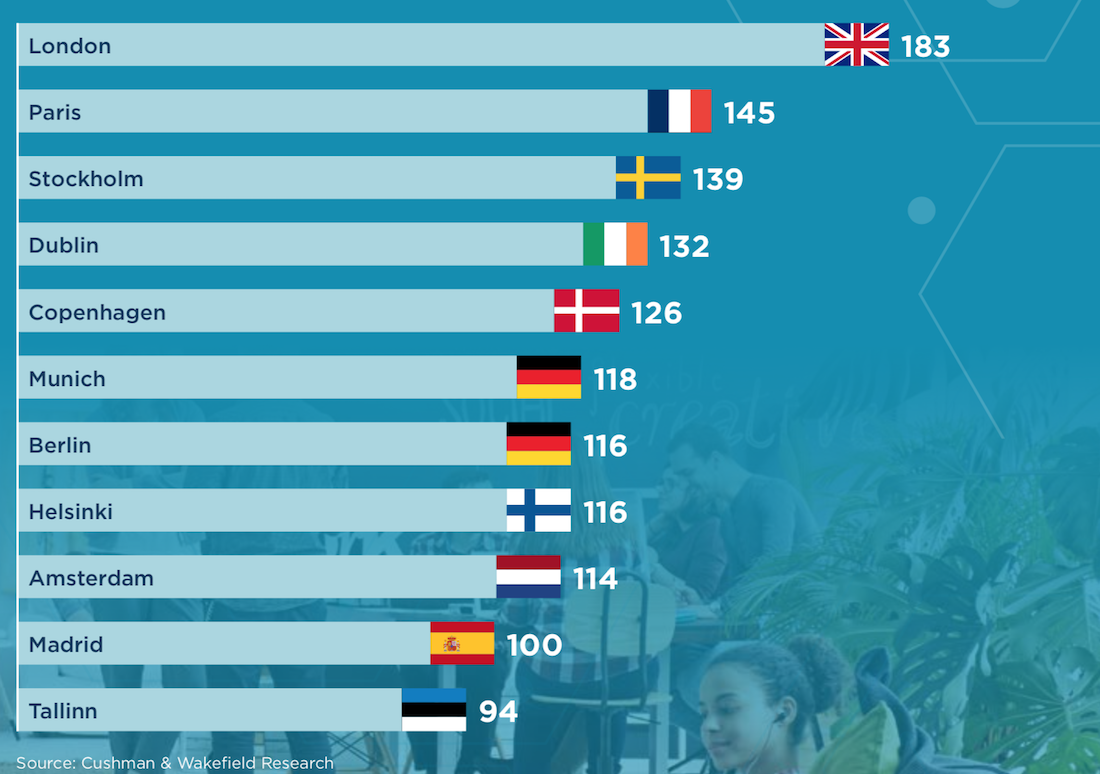

This is the question that is behind the European Coworking Hotspot Index developed by the EMEA Research & Insight di Cushman & Wakefield, comparing more than 40 Europeans cities selecting four different quantifiable economic and real estate market factors: scale, business environment, people (number of ICT employees, early-stage entrepreneurial activity, population with a tertiary education) and catalyst, such as startups, online collaboration, R&D spendings.

If the scale of the city is important, also the length of a standard lease and the current rental level are key push factors, as well as the digital infrastructure and the internet speed that foster a new kind of digital nomadism.

In fact, the spread of online collaboration must be taken into account, as well as the presence of accelerators for startups and the R&D spendings. If these are factors that show the dynamism of a city, the presence of ICT employees and young entrepreneurship secure a large group of people searching for a community-based working environment where interaction and contamination take place.

London aside, among the first 10 European cities of the European Coworking Hotspot Index we find different cities each of which presents peculiarities that will possibly foster the spread of coworking spaces: the dynamism and the excellent digital infrastructure in Amsterdam, the high level of funds and accelerators in Berlin, the ICT creativity and the R&D investment in Copenhagen are parameters that ranks these cities in the top positions, as well as for Dublin and Madrid that counts a large number of startups fast-grown in the economic situation post-crisis, for Helsinki with an high skilled labour in tech and telecoms and Stockholm where the second wave of digital creators is looking for their set for following the success of King Digital, Mojang, MySQL, SoundCloud and Spotify.

“In the future, we will see a growing demand for mixed space”, Lamberto Agostini concludes: “a mix between traditional offices and flexible offices”.

Text by Gabriele Masi.