After explaining in the previous article what are the five macro trends perceived in the furniture market in the world (emission reduction, sustainable finance, sustainable supply chain, circular solutions, sustainable consumption),

Elena Veneziani (Environment and Sustainability Division of UL) continues the synthesis of the emerging contents during the last annual summit of the furniture sector organized by UL to help us understand what are the generators of this push towards sustainability, the so-called “drivers” of sustainability.

What does sustainability drivers mean?

There are many so-called “drivers”. To name a few in Europe, we have, EU Circular Economy Action Plan, EU Green Action Plan, European Green Deal, Industrial Emissions Directive (IED) 2010/75 / EU, the Volatile Organic Compounds (VOC) Directive and Waste Framework Directive, UN 2030 agenda and Sustainable Development Goals (SDGs).

In short, it is a series of new initiatives, programs, directives, and objectives, supported by the European Union with the aim of committing everyone, from companies to society, to commit themselves to contribute, in a serious and organized way to achieving of sustainability objectives.

There is another aspect that we hear about more and more often, namely ESGs, what is it?.

ESG is the acronym for Environmental, Social and Governance. Companies are called upon to consider choices in the environmental, social and governance spheres, which aim to include a series of evaluation elements used in the financial sector to evaluate the sustainability of investments, with a view to overall evaluation of a company that goes beyond the financial results.

It is therefore increasingly common that, to evaluate an investment, or the risk / return profile of portfolios, investors also take into account the performance with respect to ESG criteria.

The ESG rating (or sustainability rating) therefore expresses a synthetic judgment that certifies the solidity of a company from the point of view of commitment in the environmental, social and governance fields. Studies1 have shown that companies operating under ESG criteria have a better level of return and risk reduction.

What are the main parameters in the environmental, social and governance fields?

Environmental sphere includes parameters such as carbon dioxide emissions, efficiency in the use of natural resources (such as water), attention to climate change, population growth, biodiversity and food security

Social sphere includes respect for human rights, working conditions, for example the use of child labor in production, and attention to diversity and inclusion in the treatment of people, control of the supply chain.

Governance sphere refers to presence of independent directors, diversity policies (gender, ethnic, etc.) in the composition of the Board of Directors, remuneration of top management linked to sustainability objectives.

ESG ratings are particularly important for the investor category, especially asset owners and asset managers (BlackRock, Vanguard, to mention a couple). For companies that do not report data, or report poor data, investors can also decide to remove investments.

How do companies understand what to do?

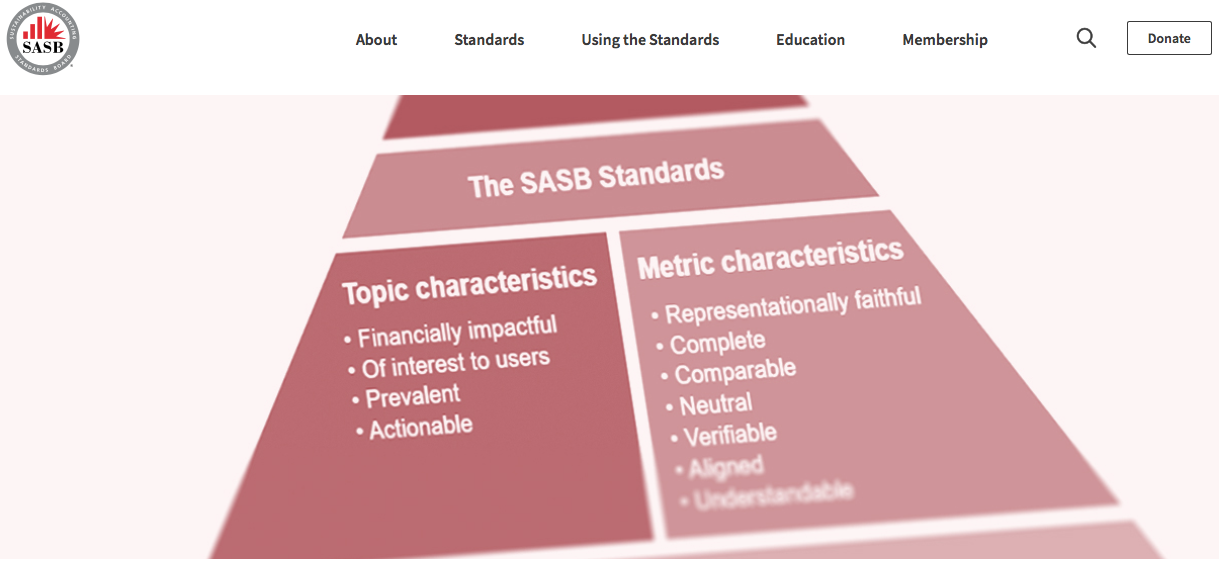

Investors often cite the SASB (Sustainability Accounting Standards Board) standards. SASB has developed 77 specific industry standards, including a standard dedicated to the furniture sector: “SASB Standards, Building Products & Furnishings”. The standard is available free of charge on the SASB website.

Looking again at the trends, we can understand that the risks themselves deriving from going in a direction other than sustainability are themselves the key drivers:

Sustainability related risks: Climate change, water scarcity and poor working conditions present risks that could have a significant impact on operations, revenues, costs and therefore financial support. Risk management therefore represents an opportunity today for the development of long-term capabilities and the development of adaptive strategies. Risks related to sustainability: Climate change, water scarcity and poor working conditions present risks that could have a significant impact on operations, revenues, costs and therefore financial support. Risk management therefore represents an opportunity today for the development of long-term capabilities and the development of adaptive strategies. We have seen, that investors are increasingly correlating better financial performance with better ESG performance.

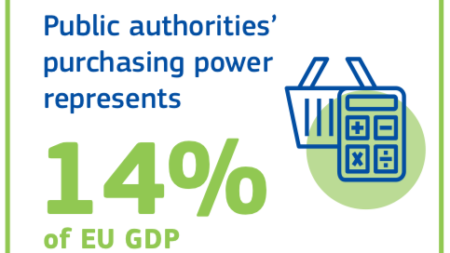

Sustainability-driven productivity: Significant cost reductions can result from improving operational efficiency through better management of natural resources such as water and energy, as well as minimizing waste and the use of renewable materials

Sustainability-advantaged growth, the financial benefits derive from a greater competitive advantage and innovation that brings access to new indicators and a positive impact on sales among end users interested in the environment.

Thanks to UL for collaboration.